Overlays, Indicators, and Oscillators

Technical Analysis is a set of tools and techniques used either to identify the market trend and/or to identify if the market is trading in overbought or oversold levels. Here are the basic categories and tools of technical analysis traders use worldwide.

-

Overlays

-

Price-based indicators

-

Volume-based indicators

-

Market and Breadth Indicators

Hundreds of different indicators are available today. Most traders nowadays use technical analysis inside MetaTrader4. Other trading platforms offer a wide variety of indicators, such as the NinjaTrader platform, which includes additionally astonishing charting capabilities. Even Ms. Excel can be used as the basic framework for implementing Technical analysis.

» Review Trading Systems at FxPros.net

Important Technical Analysis Indicators

Here is a list of almost all popular Technical Analysis Indicators and Overlays. These tools may be used by all kinds of traders: Forex Traders, Stock Traders, Commodity Traders, etc.

■ Overlays

Overlays are incorporated within price charts:

-

Support (↓_ ) and Resistance (↑¯ ) Levels

-

Trend Lines (/ or \)

-

Channels (Two Parallel Trend Lines)

-

Pivot Points (The average value of High, Low, and Close Prices, for a certain period)

-

Bollinger Bands (A Range between 2 bands deriving from the Price of Standard Deviation)

-

Price Channels (The channel formed from the highest highs and the lowest lows)

-

Moving Averages (Very popular, Simple, or Exponential Moving Averages)

-

Moving Average Envelopes (Two simple moving averages forming a price channel)

-

Parabolic SAR (It is a tool based on Stop-And-Reverse Price Levels, SAR)

-

VWAP (Volume-weighted Average Price or VWAP is the daily price formed by dividing the total value of trades in dollars by the total value of the trading volume).

-

Keltner Channels (These Volatility Channels are based on the ATR Indicator which is a tool measuring volatility)

-

ZigZag (An overlay presenting excessive price movements compared to a pre-selected filter)

■ Indicators

Indicators are presented above or below price charts:

-

Price-based indicators

-

William %R (Very popular, it is a momentum indicator measuring the Stochastic Oscillator to define overbought and oversold levels)

-

MACD (Moving Average Convergence/Divergence, a very popular momentum oscillator using the difference between two Exponential Moving Averages)

-

MACD-Histogram (Measuring the difference between MACD and the signal line).

-

Bollinger Bands %B (Highlights the relation between price movement and the Bollinger Bands)

-

Relative Strength Index (RSI) (Very popular especially when trading Forex, RSI is an indicator presenting overbought and oversold levels)

-

Standard Deviation (Measuring volatility)

-

Stochastic Oscillator (Measuring the current performance of an asset compared to past price movements)

-

Average Directional Index (ADX) (Distinguishing trending prices from oscillating prices).

-

AverageTrueRange (ATR) (Average True Range Indicator or ATR is a tool measuring market volatility)

-

Bollinger BandWidth (Measures the distance of the two Bollinger Bands -Upper and Lower Band)

-

Commodity Channel Index (CCI) (It is an Indicator measuring the current price variation from an average price).

-

Correlation Coefficient (Presents the historical correlation between the prices of two financial assets)

-

Detrended Price Oscillator (DPO) (Using moving average to define the market's cyclical moves)

-

Rate of Change (ROC) (presents the speed at which an asset is changing prices).

-

StochRSI (RSI and Stochastic combined)

-

TRIX Moving Average (A tripled moving average)

■ Oscillators

Oscillators are technical analysis indicators aiming to identify new trends and reversals. The most popular oscillators are MACD, RSI, Williams %R ADX, CCI, Stochastics, Average Directional Index (ADX), and Relative Momentum Index (RMI).

■ Volume-based indicators

Here are some volume-based indicators:

-

Volatility Indices – (Indicators measuring implied volatility)

-

Accumulation/ Distribution Index (Measuring the cumulative flow of inflows and outflows)

-

Money Flow (Measuring Money Inflows and Outflows)

-

Chaikin Money Flow (Measuring Money Inflows and Outflows)

-

Accumulation Distribution Line (Presenting price and volume combined to highlight the money inflows and outflows of a certain financial asset).

-

Money Flow Index (MFI) (Presenting shifts in buying and in selling pressure, a tool operating similarly to RSI)

-

On Balance Volume (OBV) (Presenting Inflows and Outflows based on the price and the volume)

■ Market & Breadth Indicators

These indicators are based on statistics derived from the broad market

-

Put/Call Ratio (A very popular sentiment indicator that is calculated by dividing Put Options Volume by Call Options volume).

-

Net New Highs (Calculates the difference between new highs and new lows)

-

High-Low Index (Presents new highs as a percentage of new highs and new lows).

-

Arms Index or Traders Index (TRIN) (It is a market sentiment indicator comparing advancing and declining trading volume)

-

Advance-Decline Line and Volume (Two cumulative breadth indicators)

-

Advance-Decline Line (Presenting the change of Advance / Decline Index over time)

-

McClellan Oscillator (An Oscillator similar to MACD)

-

McClellan Summation Index (Cumulative indicator of McClellan Oscillator)

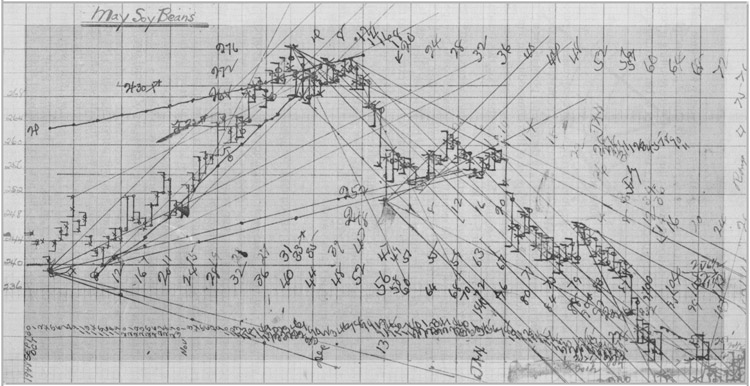

Technical Analysis Before the Age of the PCs

Before the age of PCs, traders used their exceptional design skills to draw technical analysis charts by hand. Although it sounds tough and not accurate, these traders had the privilege to access market information and identify new trends, market demand, and supply levels. That was a clear competitive advantage for those traders and competitive advantages can create profit opportunities no matter the Industry and the period.

Image: The Personal Soybean Chart of the famous investor William D. Gann (1948)

Creating Customized Trading Systems

Several applications can help traders transform their trading ideas into fully automated systems. One of them is EA Builder which can also create simple indicators and it is 100% free. There is no need for programming skills and even beginners can create complex trading systems. You can trade any financial asset (Forex, Equities, Commodities) and use it on three trading platforms (MT4, MT5, and TradeStation).

-

Custom trading systems and EAs by adding TA Indicators with multiple functions

-

Platform: MetaTrader4, MetaTrader5, TradeStation

-

License: Unlimited Real / Demo Accounts

EA Builder offers a user-friendly interface with graphical functions and pop-up help windows. There are also 15 video tutorials for making things further easier. EA Builder offers a full set of functions including stop-loss calculation and more complex money management tools. The EA Builder is free for creating indicators.

» EA Builder website | » Creating Learn more about AA Builder

Final Thoughts –Do it your Way and Never Join the Vast Majority of Traders

Technical analysis tools are great, but whatever tools you choose you must always try to differentiate from what the vast majority of traders use. It is better not to use the tools that everybody else uses, especially under the same settings. Try to build in a sense your system. If you can’t build an efficient system, it is better to use outsourcing, meaning a reliable trading signals service.

Here is why:

If we take into consideration the trading industry’s statistics, more traders lose money than gain money. In other words, the number of losers is greater than the number of winners. This happens when trading the transactional cost becomes a part of the losing side. If we assume equal positive and negative trading returns, the total sum would be negative and equal to the value of the aggregate transactional cost in the market. If you do exactly what everybody else is doing then consequently you will have to join the vast majority of all traders, which as we mentioned before, is losing money.

Tip: “When Trading Intraday, you must be a Contrarian and Think as the 5% of all Traders -Not as the Rest 95% Does”

◙ Technical Analysis Tools –Full Overlay and Indicator List

G.P. for FxPros.net (c)

L MORE on FXPROS.NET • COMPARE • LEARNING • TRADE SYSTEMS

□ Broker Ratings

□ Expert Advisors

□ Forex Brokers

► Getting Started with Forex

► Getting Started with Trading Systems

► How to Choose a Forex Broker

► Getting Started with Algorithmic Trading

► Identifying the Forex Trend

► Overlays and Indicators

► Forex Trendy

► 1000pip Climber

► EA Builder

► StrategyQuant